Flexible financing options anywhere a sale takes place.

Buisness Credit

Why BLK Financing?

1 out of 3 Americans have credit scores of 650 or lower, so you couldn’t approve them UNTIL NOW!

- Accept and convert customers w/ credit scores as low as 515

- Approve clients from $500 to $35,000

- Offer terms up to 84 months

- Offer same-as-cash (no interest) programs for 6-12 or even 18 months

- Helps your customers and clients build credit by reporting as a tradeline

- Doesn’t ding their credit score during pre-approval

- Get clients approved in 5-7 minutes

- We specialize in serving the markets no one else will finance

- Get all your money deposited in 2-3 days

- Help thousands of the underserved

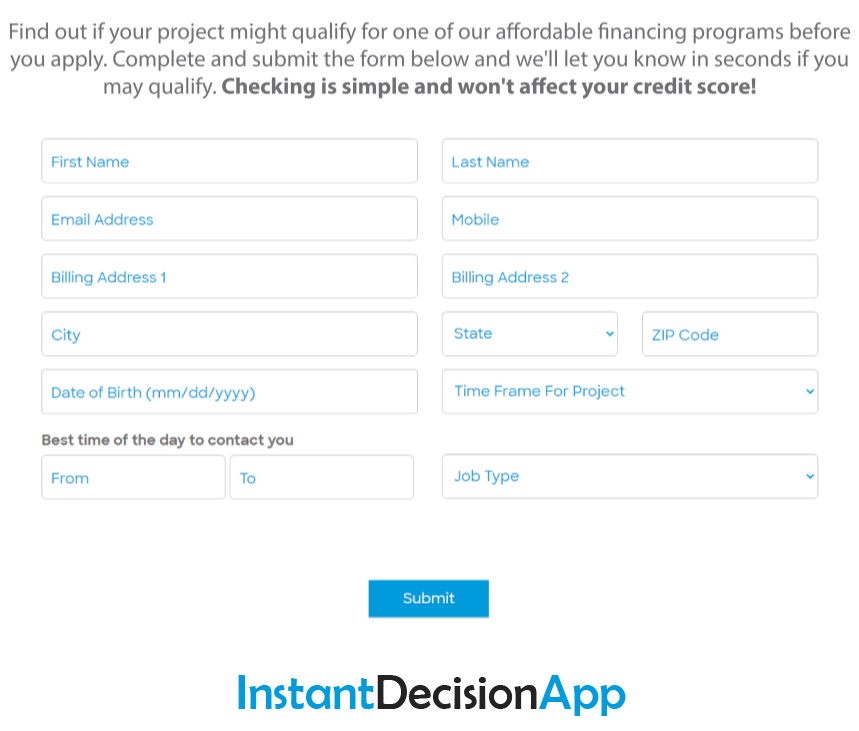

Introducing

Prescreen your sales leads for available financing offers in seconds!

Your customers learn in seconds if they qualify for financing their purchase with you. With only a soft credit check!

Financing applications are merchant industry specific, to optimize lead conversion and attract the best lending offers.

Closely track and follow up with your qualified customers to increase sales volume.

A secure, contactless and easy-to-use application can be accessed at your customer’s convenience.

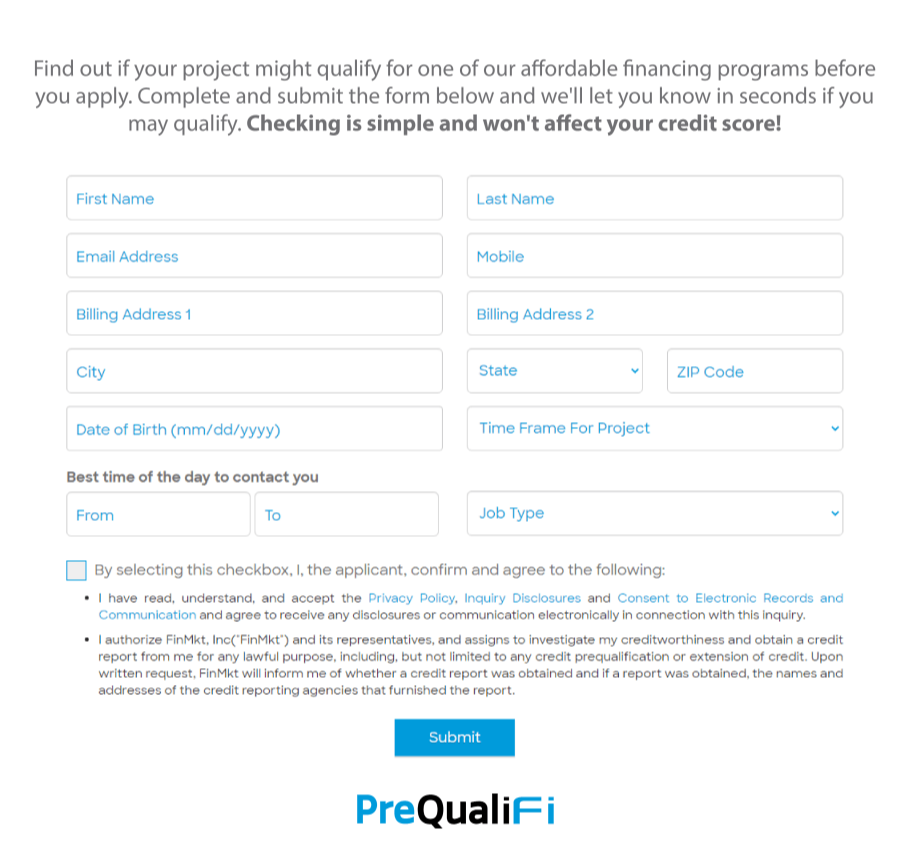

Introducing PreQualiFi

Prescreen sales leads for available financing in seconds!

Learn more about

InstantDecisionApp

and start qualifying - and closing - your sales leads today!

*We don't share your personal info with anyone. Check out our privacy policy for more information.

Learn more about PreQualiFi and start prescreening leads today!

*We don't share your personal info with anyone. Check out our privacy policy for more information.

Currently Partnering with Industry Merchants:

• 620 credit score required for merchant approval

• The underwriting process can take up to 4 business days.

Coaching & Consulting

- Motivational Speaking

- Workshops & Seminars

- Financial Consulting

- Fitness/Gym/Sports Programs

- Life Coaching

- Business Consulting

- Career Coaching & Consulting

- Health & Nutrition Consulting

Healthcare

- Dental

- LASIK & Vision

- Cosmetic

- Acupuncture

- Hearing

- Veterinary

- Alternative Medicine

- Elective Surgery & Treatments

Home Improvement

- Roofing

- Pools & Spas

- Renovation

- Solar

- Landscaping

- Windows & Doors

- HVAC

- Siding

Retail & Ecommerce

- Home & Outdoor Furnishing

- Jewelry & Luxury Goods

- Fitness Equipment & Sporting Goods

- Computers & Electronics

- Recreational Vehicles

- Travel & Entertainment

- Fashion & Apparel

- Beauty & Skincare

The Merchant Application Review

While we attempt to approve every merchant, we are unable to approve all applications. Please review this list of the most common reasons we’re unable to approve a merchant before you continue with the application process.

- Outstanding financial obligations including liens, judgments, and bankruptcy within the last 2 years.

- Business license and/or trade license inactive, not in good standing, or revoked.

- Felony criminal record within last 20 years.

- Misdemeanor Fraud or Theft within the last 20 years.

- Current/active lawsuits or litigation.

- Time in business is at least 6 months for Coaching, Retail and Healthcare. At least 1 year for Home Improvement.

- Credit Score. A soft credit check will take place after the submission of the merchant application. The average Transunion FICO credit score of the owners must be 620 or higher. If only one owner, his or her Transunion FICO score must be 620 or higher.

- Businesses must have at least $250,000 annual sales revenue

Want information on the interest rates you will offer?

You determine the interest rates of your clients based on the merchant fees you accept. Choose your industry below to see the associated interest rates and merchant fees. Offering lower interests require stricter credit requirements for your customer base and higher merchant fees. There are no prepayment penalties.

A Win-Win ALL-IN-ONE Platform

BLK Financing delivers an all-in-one customer financing and merchant paid-in-full solution.

How it Works

Watch this 1 minute video to see how BLK Money can start working for you and your business!

Why Work with BLK Money?

We are BLK - ( Birt Legacy Kingdom) - Creators of Legacies, Recipients of Financial Freedom & Inheritors of Generational Wealth

Frequently Asked Questions

Point of Sale Lending Partners